The insurance premium which is required to cover the expected potential cost of a claim is called a “pure risk premium.” But how exactly is this figure calculated, and why might the average consumer be paying too much to cover their risk?

Any actuary worth their salt can attest to the fact that the elusive pure risk premium figure takes a fair amount of data collection and crunching to determine. There are all kinds of factors to take into consideration: the person, the vehicle, where the vehicle is parked, past claims, driving history, and other data relevant to a car insurance policy.

To get to this figure, each person and the car insurance policy associated with them is assumed to fit into certain groups. Groups of people, groups of vehicles, and other groups made up of different data sets. And of course, a lot of assumptions (based on data) would be made about these groups. A number of test assumptions would also be used to make sure the premium is calculated accurately to fit the potential risk of any person with a car insurance policy. Throw in some multivariate models and a very good assumption can be made of what the risk premium should be of an insured vehicle.

However, assumptions cannot always accurately account for reality.

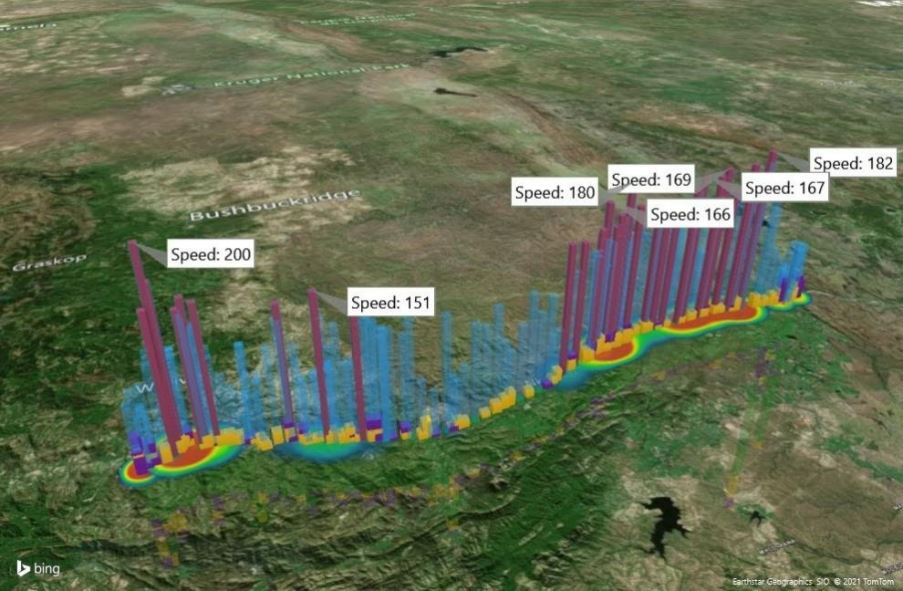

The illustration above is an actual trip among hundreds of similar trips made by an actual person in an actual vehicle. This data was used to calculate the actual risk involved with this person when calculating his pure risk premium. In calculating this person’s premium actual data was used – not assumptions.

Here is where things get interesting. Prior to the use of his actual data, his assumed risk premium calculated to a fair average premium. It was similar to a person of the same age, living in similar location, and driving a similar vehicle. The policy was rated average and the derived premium he paid was average.

After using the actual data over a period of twelve months to quote on premium, the insurer realised that the risk was simply not worth the highest possible premium applicable to this policyholder. It’s clear from the data that he was driving at excessively high speeds, making him a higher-than-average risk for a large claim. Despite that, he was paying an average premium.

In this instance, due to the amount of high risk trips taken, the insurer chose not to offer vehicle insurance. The policyholder moved to another vehicle insurance provider, and 43 days later, submitted a write off claim which also included damage to property. Without telematics data – which provides valuable data about how a person drives – the actual risk would never have been known to the insurance provider.

Don’t you think it’s time to make use of telematics data to calculate car insurance premiums? If you’re a safe driver, telematics data could save you hundreds or thousands of rands a year when calculating premiums. Why? Because you won’t be paying to cover high-risk drivers who are of an otherwise-similar profile to you.

Check out other articles you might be interested in

Pure risk premiums could be increasing your car insurance cost

The insurance premium which is required to cover the expected...

Read More