Data science

Insurance Risk Mitigation

Gullwing Telemetry Solutions is data personified.

We offer data science services to the insurance and finance industries.

GTS comes to the table with an internally developed architecture that develops tools and risk proxies able to be integrated into a client’s internal rating engine. Our platform allows for harvesting multiple data points from multiple sources to deliver a bespoke, solution-driven service.

This means GTS is able to target specific areas of risk that cater for any insurance or finance product. The outcome remains the same: Reducing client risk. Reducing loss ratios. Improving overall driver behaviour.

“

niche insurance products to commercial and short-term personal line business

“

GTS has the ability to not only immediately notify our customers of loss but continue and finalise the process to ring-fence and manage a loss as fast and cost effective as possible.

Fast and cost effective

Our company consists of three central skill sets that drive all of our solutions within the insurance and finance industry;

- Insurance risk mitigation strategy

- Data sciences and aggregation

- Operational orchestration and systems integration.

GTS ensures a seamless data flow from harvest points to result delivery.

Gullwing Telemetry Solutions (PTY) Ltd is a South African start-up focussing on data science and insurance risk mitigation.

Established in 2018, GTS was a response to a paradigm shift within the short-term motor insurance industry; the market saw proven results in the use of dynamic data deployed with actionable operational strategies to improve insurance companies’ loss -ratios.

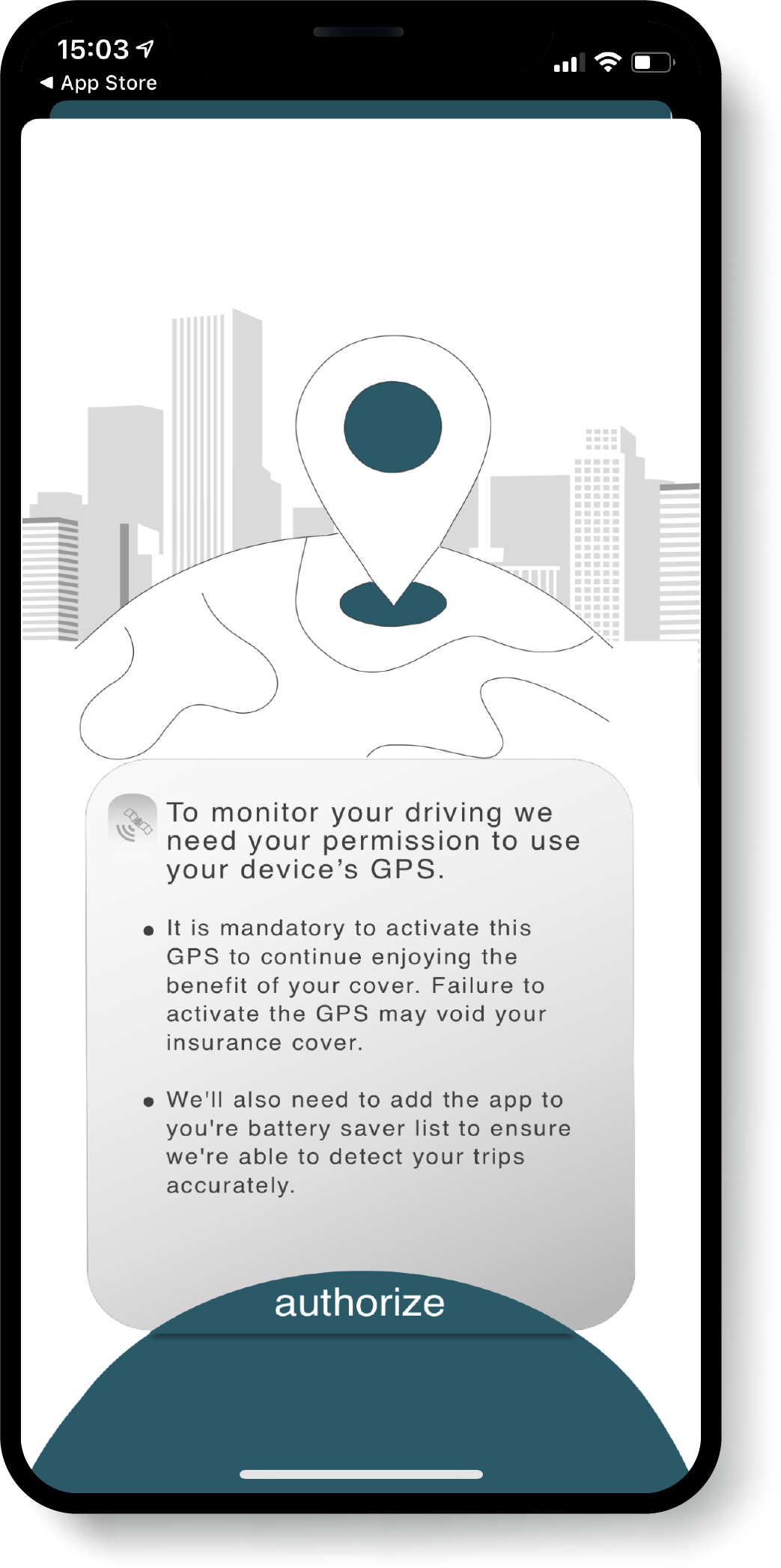

Its Web-based Software as a Service environment enable an immediate and seamless activation of any usage-based insurance product.

We pride ourselves in our ability to cross pollinate and formulate data driven strategies with our in-depth knowledge of behavioural sciences tied to data mining, aggregation and moulding capabilities within any industry that uses any form of data. Our intellectual property is retained from our different backgrounds in insurance, data sciences and telematics technologies. Through our combined experiences and

in-depth research, we’ve built up strong industry knowledge and merged our separate knowledge bases to provide solutions to data motivated customers.

Additional value generated by high quality data accessibility:

Mitigating potential fraud or financial leakage during the claim stage as all data is immediately available the moment a loss occurs.

The data imported and aggregated agnostically, is churned through our internally developed algorithms to develop specifically created result sets that accurately delivers

specific-to-product risk data toward the insurer. This data would be normalised from how it would have been received from the individual and different originating data sources, whether it be a data supplier such as Google, Esri or a Telematic device, mobile devices or indoor sensory equipment.

This creates an absolute value within the client as he is enabled with dynamic “on-the-spot” visibility on the risks related to his policyholder. GTS then has the skills required to push the results sets into operational action to drive down potential losses before they occur.